Investors guide to buying Stellar in the UK

Stellar (XLM) and its Lumens token are often compared to Ripple. In fact, it is often called “the poor man’s Ripple.” Where Ripple seeks to move money globally more efficiently and cheaply between banking partners and major corporations, Stellar has chosen to focus on individuals, especially if they reside in economically depressed countries and have yet to have access to better ways to move money around the world. By offering low-cost banking services to people with fewer financial means, Stellar hopes to fulfil its mission to “fight poverty and maximise individual potential.”

While Stellar Lumens enables cross-border payments and represents a store of value, its unique connectivity also allows it to be a platform that can launch initial coin offerings (ICOs). It differentiates its network by using a unique consensus protocol, Stellar Consensus Protocol (SCP), that reduces the number of nodes required to approve a transaction. The Stellar Development Foundation (SDF), a non-profit organisation, has oversight responsibility for the code and is funded by 5% of outstanding tokens. Interest in Stellar was jump-started in October 2017 when a partnership with IBM was announced. Valuations quickly soared; they then fell but have recovered. XLM fluctuates between 10 and 15 on ranking lists with a market cap of $17.8bn.

Where to buy Stellar?

Why buy Stellar?

Jed McCaleb and his close associate, Joyce Kim, founded the Stellar network in 2014. McCaleb was an early pioneer in the crypto space, helping to co-found both Ripple and the Mt. Gox exchange in Japan. After a significant hacking compromise forced Mt. Gox into bankruptcy, the Ripple Labs group asked McCaleb to seek employment elsewhere. Due to this history, it is often rumoured that Stellar might be a fork of Ripple or based on Ripple code, but neither of the suppositions is true.

The truth is that McCaleb went his own way, determined to create a better platform that addressed transaction speeds, scalability, and operational cost issues. He established the Stellar Development Foundation, a non-profit entity operating out of San Francisco and New York. McCaleb then acquired three million dollars of seed money from the Stripe payments corporation. From that humble beginning, he has created an innovative authentication algorithm and arranged partnerships with a host of brand named companies, including IBM, Deloitte, Samsung, and the Ukrainian ministry.

Whereas Ripple has focused on banking partnerships and large corporate customers, Stellar has been targeting individuals in need of basic financial services worldwide. Its platform is open source code and is designed to provide developers with tools to design, test and get new apps up and running more quickly. With technical barriers held to a minimum, Stellar’s stated goal is “to combine all of the world’s financial systems into a single, borderless, interoperable network.”

What makes Stellar different? Its approach to authenticating transactions does not originate from a mining protocol, as with most other major platforms like Bitcoin and Ethereum that rely upon a Proof-of-Work process. McCaleb and his team chose to modify the Federated Byzantine Agreement to produce its Stellar Consensus Protocol. Credit is given to David Mazieres, a computer security systems professor at Stanford University, for devising a consensus process that permits a network of selected nodes, known as quorum slices, to validate transactions.

The result is that Stellar is independent of an enormous mining exercise to create new blocks. Fees are significantly reduced because transaction approvals come quickly without logjams and with greater speed. The network also has the advantage of being able to link up easily with major banking interests. These “anchors” can include regulated financial institutions, money service providers and Fintech companies. These attributes assist with interoperability issues between established banking interests like SWIFT and regional payment associations.

How robust is the Stellar network? By 2015, registered users on the platform had grown to three million. By June 2020, over 450 million operations had been performed on behalf of four million users. A recent agreement with ICICI Bank in India is another step to open that market up to cheap cross-border payments for the Indian diaspora. Similar efforts are also ongoing in Africa.

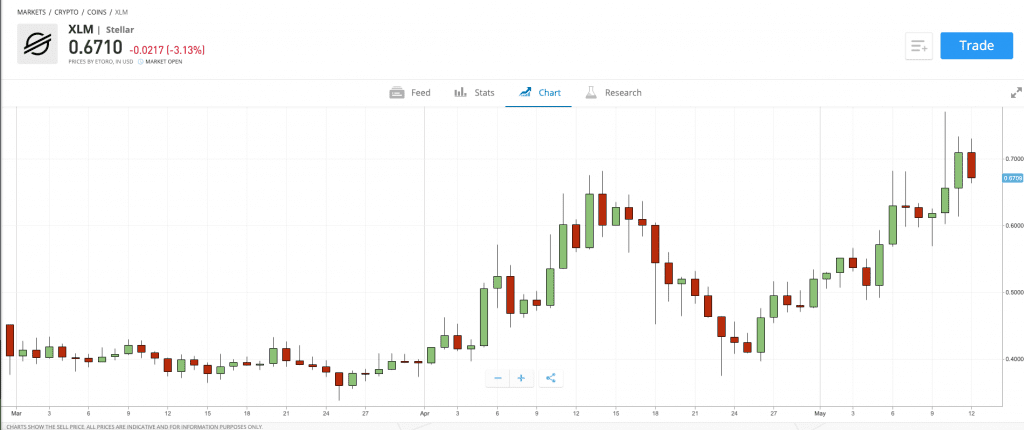

Is Stellar XLM a good investment? Its price has risen fourfold in 2021. Analysts have suggested that this dramatic burst resulted from the SEC dragging Ripple into court, but Stellar is not a Ripple look-alike. Each company may have similar goals, but their aspirations are following different trajectories. Stellar appears more open to cooperating with legacy banking networks, whereas Ripple wants to revolutionise the status quo. Analysts see more multiples in price, even $5 in five years, but the crypto-verse could swing up or down.

Step by step guide

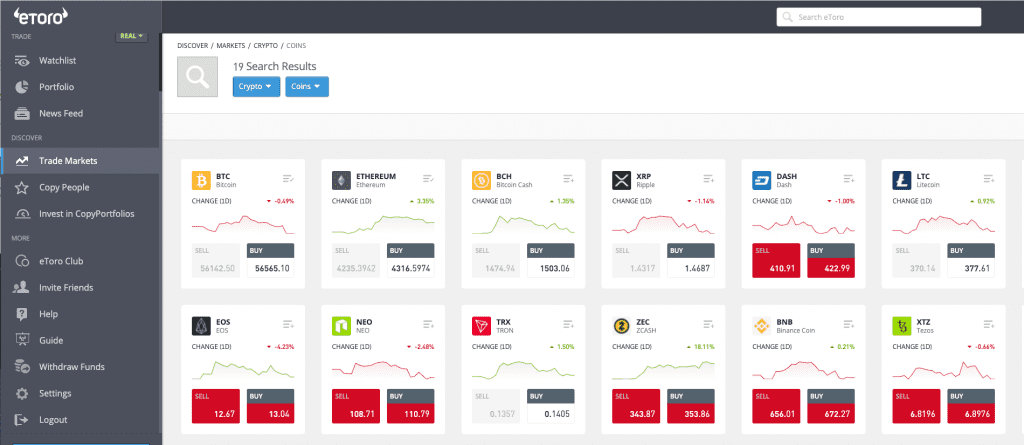

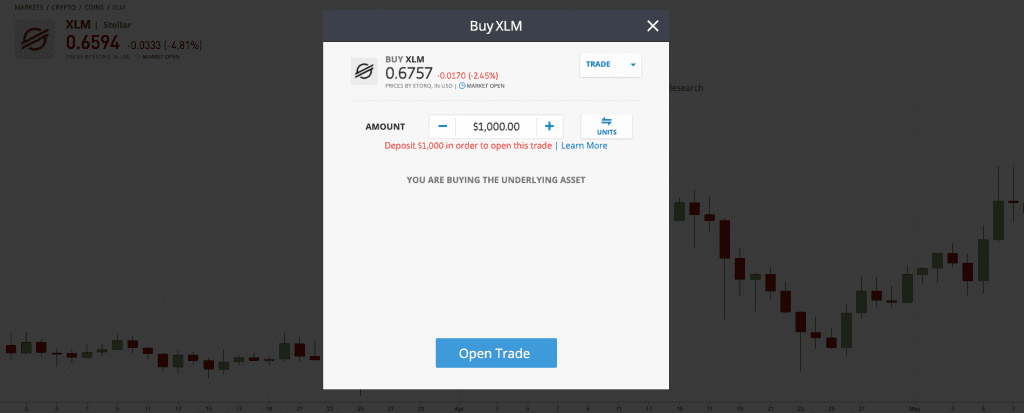

The success of the Stellar Lumens network has made it a mainstay on most exchanges and online brokerages for both trading and investing. It is now straightforward to buy Lumens in five brief steps, as demonstrated by the screenshots from the eToro.com website presented below:

Step 1: Join now: Simply go to the eToro website and click the “Join Now” button. The application will require personal ID information from you, as dictated by local law, and answers to basic profile questions to assess your investment goals.

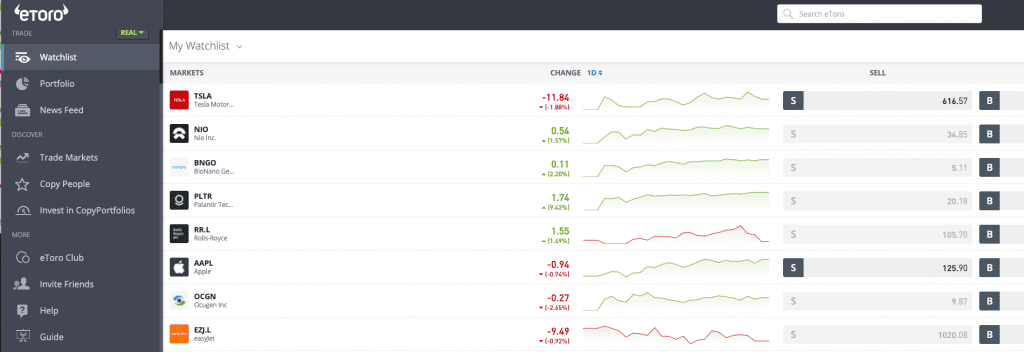

Step 2: Receive approval: Broker approval will take roughly a minute. Your desktop screen will appear. The “Real” status is for trading and investing. The “Virtual” status is for practice, a prudent exercise for all beginners. To proceed, select “Deposit Funds”.

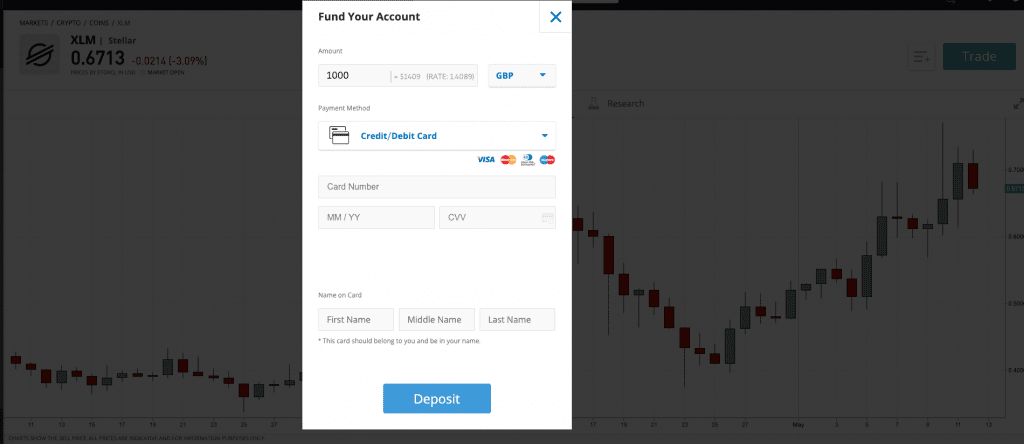

Step 3: Deposit funds: Depending on your place of residence, you will be presented with account funding options to deliver your fiat currency to the broker. The example shown below is for a credit/debit card, but there may be other less costly options available. You must decide what is best for you.

Step 4: Select XLM: You now must locate XLM on your desktop. Press “Trade Markets” to the left, and then select Cryptos at the top of the screen. You will need to scroll down to find XLM. When ready, press the “Buy” button.

Step 5: Execute order to buy: At this point, you will need to decide how much to invest. Enter the amount in the Amount field, and when ready, tap the “Open Trade” blue button. Your trade order will be executed by eToro, and your XLM investment will appear in your portfolio.

Conclusion

Should you invest in Stellar? The analyst community is positive in its comments and predictions regarding this cross-border payment network innovator. Its partnership with IBM and with several other names in banking and payment technology is one reason, but its quickness and scalability, together with low costs, are what win the day. As long as its consensus algorithm runs circles around those of its competitors, its future remains bright, at least within the realms of crypto blockchain networks. As decentralised ledger systems expand their presence in traditional environments, the Stellar network will benefit from such progress.

Stellar, however, has yet to ascend above $0.90 per Lumen, its high from three years back. There are forecasts of this recovery event happening over the next 12 months, and more long-term outlooks for 2025 congregate anywhere from $2.00 to $5.00. As with any other crypto, there are downside risks to consider. Several other competitors in the crypto arena are trying to achieve success in the cross-border payment space. There are also regulators and government officials who are having difficulty embracing cryptocurrencies. It would be unwise to underestimate the risk factor of XLM, but if you see reward potential, it might make it a worthy choice.