Investors Guide to buying Bitcoin Cash in the UK

If Bitcoin is the king of all cryptos and a good investment in the crypto-verse, is Bitcoin Cash (BCH) as good? Not necessarily, since BCH is nowhere near number one in the market, even though hovering around a number ten ranking is not bad. Bitcoin Cash arose in 2017 due to philosophical differences in how the Bitcoin blockchain platform should be enhanced going forward. A sub-group of the nodes on the network wanted larger blocks to improve scalability, speed, and price, but the majority objected.

A hard fork was the result in August 2017, and each holder of BTC tokens also received the same amount in BCH tokens. The Bitcoin Cash development team did create larger block sizes that could contain ten times more transactions than the original BTC platform. More transactions processed within the same period meant that prices could drop to $0.20 from $1. Unfortunately, the bitter debates and feuds continued. BCH forked into BSV in November of 2018 and forked once again in November of 2020 to create BitcoinABC or BCHA. BCH prices have only slightly recovered in 2021, with the market cap standing at $14.6bn.

Where to buy Bitcoin Cash

Why buy Bitcoin Cash?

Bitcoin Cash or Bcash, as many observers refer to it, was spun off from the original Bitcoin model in August 2017. That was when the community of investors, developers, and miners could not come to an agreement over how to deal with fundamental problems in the Bitcoin blockchain architecture. Bryan Kelly, a noted stock analyst, described the split as nothing more than an unfortunate software upgrade: “When you do a software upgrade, everybody usually agrees. But in this particular case, everybody is not agreeing.”

The issues were speed, scalability, and price. Bitcoin limited the size of one block to 1MB. To scale up and handle more significant volumes of transactions, a subset of the BTC family felt that raising this cap up to 8MB would be the best solution. There were other issues related to what would eventually become the Lightning Network for Bitcoin, but the disagreement focused on whether to change the original Bitcoin code. That was viewed as heresy by many purists.

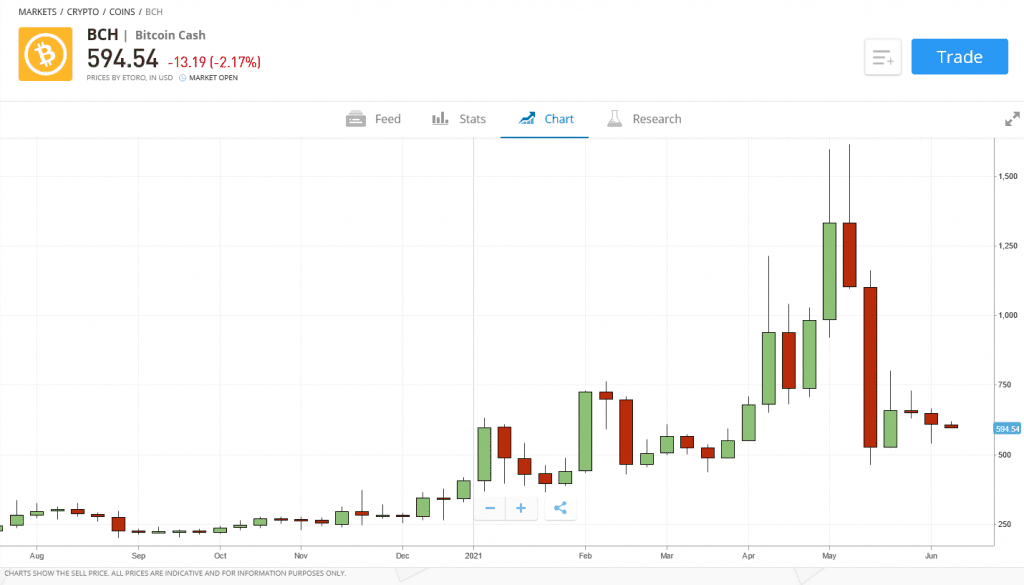

On the 1st of August 2017, owners of BTC tokens received an equal amount of BCH tokens. Prices for both coins fluctuated in the market until a new equilibrium was set, but each token was caught up in the buying frenzy that erupted months later. BTC has recovered its All-Time-High of those halcyon days, but BCH presently sits at 21% of its former high-water mark.

Part of this sluggishness may be due to two other hard forks; controversy seems to follow this crypto like a cloud. In November 2018, Bitcoin SV was spun off, claiming to be more what its founding father, Satoshi Nakamoto, had intended. This new “Satoshi Version” would incorporate a new block size limit of 128MB. In November 2020, a new civil war ensued that spawned BitcoinABC or BCHA. News is evolving, but BCHA will have a 32MB limit and a special funding arrangement whereby mining rewards will fund a portion of future developments.

The BCH team also wanted to make mining a little easier and less cost-intensive. Both Bitcoin and Bitcoin Cash utilise the Difficulty Adjustment Algorithm (DAA) so that block generation times average out to ten minutes. BCH added a new twist called the Emergency Difficulty Adjustment (EDA) algorithm, which decreased mining difficulty by 20%. That soon produced instability. The EDA was discarded, but the original DAA was modified. Researchers also found a bug in the basic software in 2018, but it was soon fixed.

Is Bitcoin Cash a good investment? Although the spin-off from Bitcoin has had a somewhat volatile journey since its creation, it has still amassed a broad level of support among the crypto community. It is safe to say that a good deal of misinformation has been spread about this project, the aftermath of deep-seated arguments over format and direction. For those same reasons, many supporters feel it is currently undervalued. One founder maintains: “It’s a flagship cryptocurrency with solid fundamentals.” Time will tell if that is the case.

Step by step guide

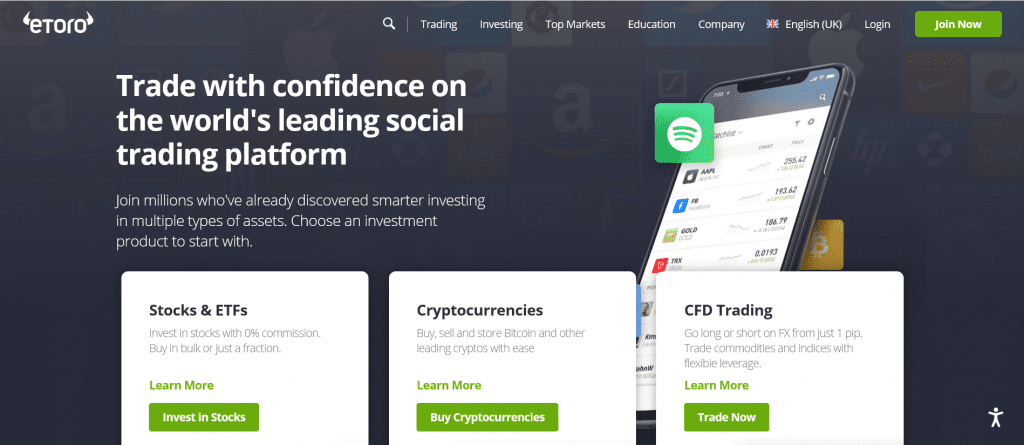

The good news is that you no longer have to deal with an unfamiliar foreign or domestic cryptocurrency exchange to purchase your crypto investment. Several online brokers can now act as your agent in the buying process. In fact, by using eToro.com, you can own BCH in five easy steps:

Step1: Go to the eToro.com website and select the “Join Now” button. The application process is short, but you will be required to submit personal ID information as required by the Financial Conduct Authority.

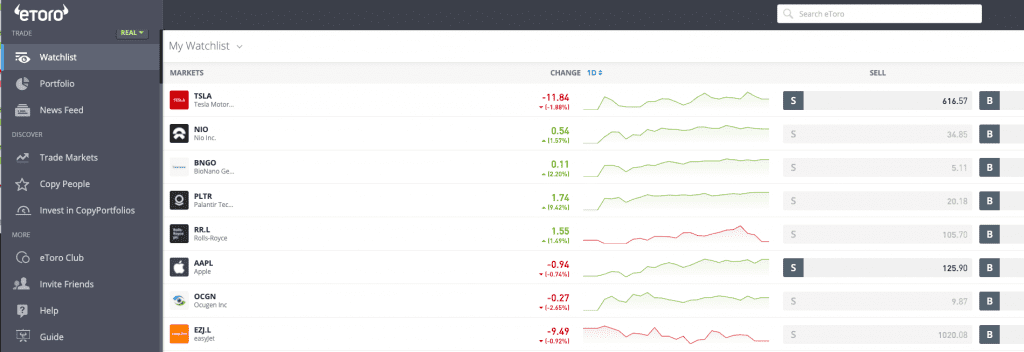

Step 2: Approvals come quickly. Your Desktop screen will ask you to “Deposit Funds”.

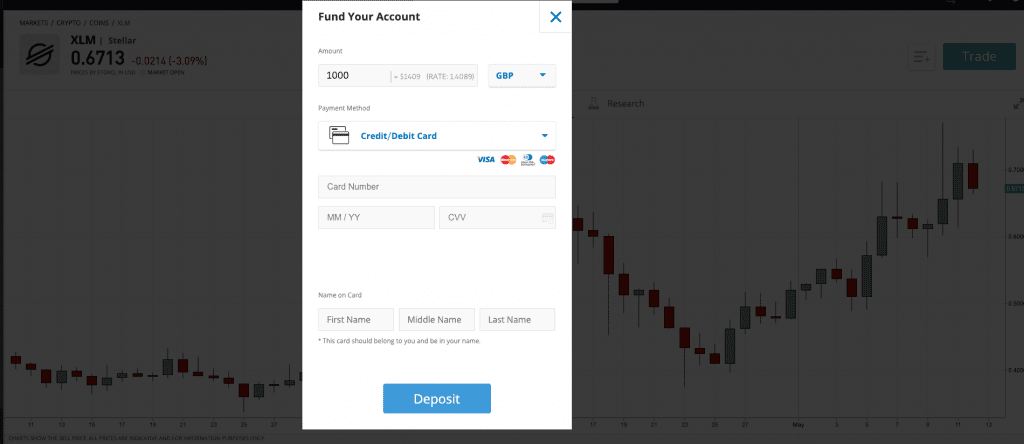

Step 3: Several funding options will be presented by eToro, dependent upon your country of residence and methods supported by local banks. The example below is for a credit/debit card. Decide on an amount and execute your funding order.

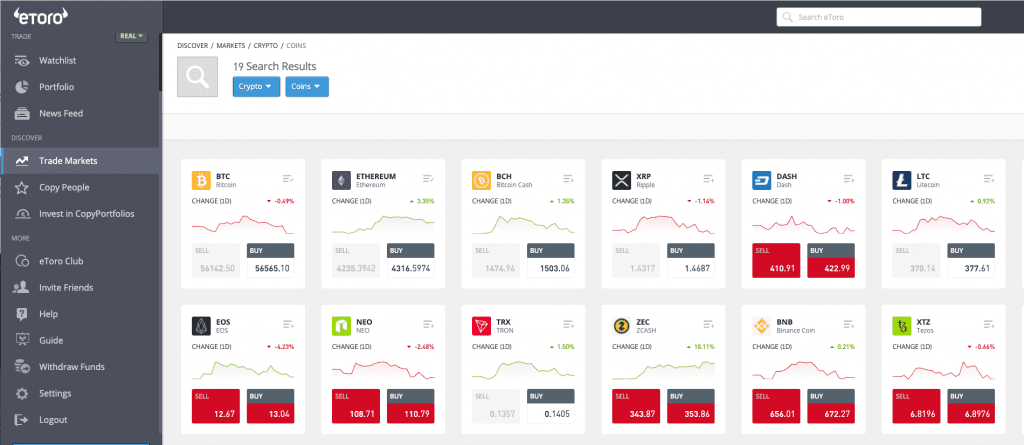

Step 4: When funds are posted to your Portfolio, you are ready to invest. Select the “Trade Markets” tab, press “Cryptos” at the top of the screen and scroll to BCH. Press the “Buy” button.

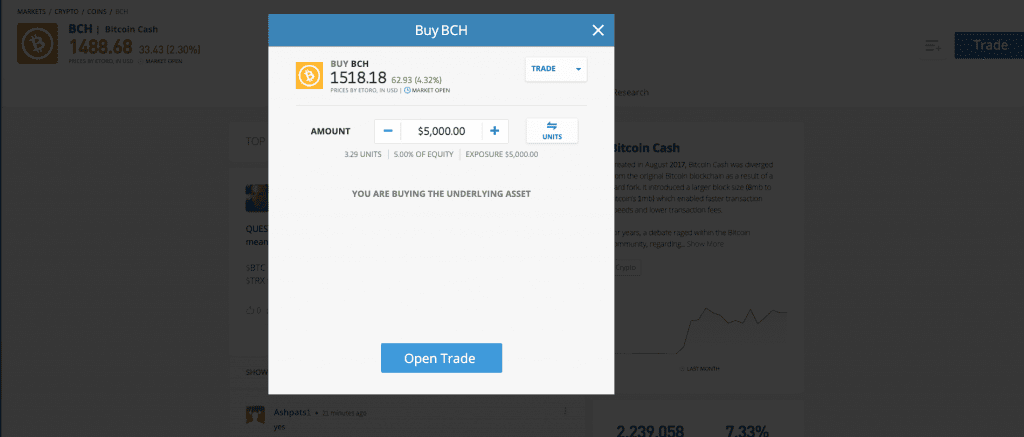

Step 5: Lastly, enter the amount you wish to invest and press “Open Trade”. The eToro platform will take your order, execute it, deliver your units to your Portfolio, safeguard them, and deduct the appropriate amount of cash from your account for the purchase.

Conclusions

Bitcoin Cash is definitely not Bitcoin. It may share similar attributes with its larger brother, but Bcash has been embroiled in controversy since its birth in August 2017. It has ridden the wave of asset appreciation, as have other altcoins, but the degree of its recovery has been stunted. Does this slow comeback disguise the possibility of a major run-up in the near term?

One cannot ignore that Bitcoin Cash has a market cap of $14.6bn and a daily turnover of $5.7bn. BCH has significant investor backing for its goals, but is that real support or mere speculation? Bitcoin Cash is currently number eleven on the ranking charts. It has held that position despite two significant forks, but it still represents a major risk. Anything could happen, including a good deal of volatility in price, both up and down. This token is not one to take your eye off, but if you are into taking chances, BCH could be a surprise waiting to happen.