How to buy Ethereum Classic in the UK

Ethereum Classic (ETC) is a case study of the evolutionary history of the Crypto-verse and its supporting blockchain technology. ETC was born in July of 2016 when the more popular Ethereum network spun off via a hard fork to become ETH. As a result, Ethereum Classic actually maintains the original blockchain history before the split and thereafter. The decision to split was predicated by a hack of $50 million. ETH followers preferred to roll back the blockchain to reverse the thievery, while ETC advocates staunchly defended the immutability of the blockchain.

How has the divorce played out? Both networks remain very similar. Each token is a cryptocurrency with a platform that enables smart contracts and decentralised applications (dapps). Ethereum founder Vitalik Buterin, a majority of his developers, and the Ethereum Foundation elected to get the ETH path.

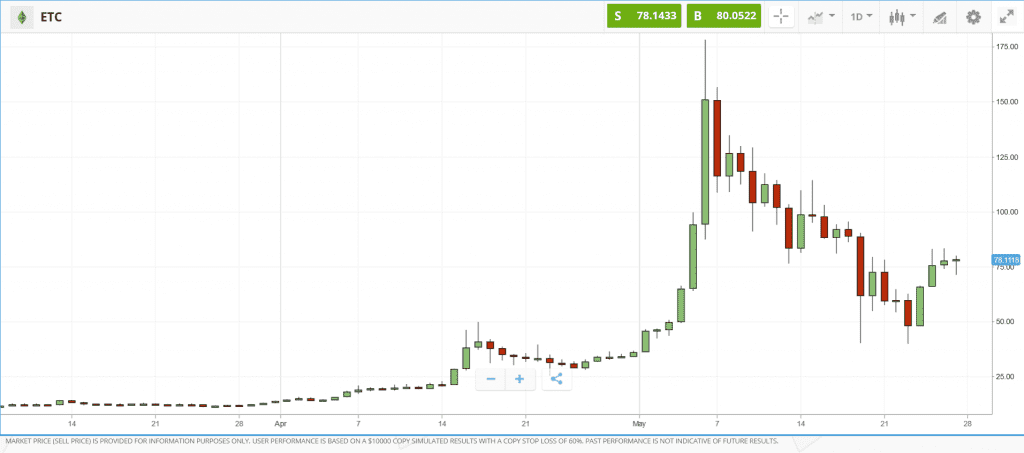

While the market approved the split by raising the prices for each token, ETH has prospered greatly, maintaining its second rank behind Bitcoin. ETC, however, has had its difficulties. It is ranked number 35 with a market cap of $2.4bn. Its price history has been a bit of a rocky road, but Ethereum Classic has found support in 2021.

Where to buy Ethereum Classic?

Why buy Ethereum Classic?

Ethereum Classic (ETC), not to be confused with its cousin Ethereum (ETH), was born out of an ideological disagreement between the founder of Ethereum and most of the developers using the platform. It came into being on 20 July 2016, when a ‘hard fork’ split the system into two tokens, ETC and ETH. Vitalik Buterin, the founder of ETH, and his loyal developers, along with the Ethereum Foundation, moved on to fame and fortune, achieving a number two status directly behind Bitcoin. Ethereum Classic has languished.

Both systems have similar capabilities and operate on similar blockchain platforms. Each network is decentralised and has open-source blockchain code, which facilitate online payments and the development of applications that utilise smart contracts. These self-executing contracts are finding real-world applications in nearly every business sector, especially in finance and real estate, where there is a need to eliminate intermediaries in the exchange of value process.

On 30 July 2015, Ethereum was launched, the brainchild of Vitalik Buterin, who envisioned an opportunity to expand the usage of blockchain technology far beyond the notion of Bitcoin. The use of smart contracts was not something new, but the security and immutability of the blockchain decentralised ledger system became an ideal launchpad for these new autonomous software applications.

In 2016, The DAO was an early decentralised autonomous organisation, which chose to use Ethereum smart contracts to act as a venture capital firm, solely directed by its investors. $150m of capital was raised, but a major flaw in the software allowed hackers to steal $50m. Buterin and his team wished to roll back the blockchain to reverse the theft transactions, but blockchain purists were opposed to modifying what they perceived as being immutable.

The disagreement caused the two groups to part ways. Ethereum Classic maintained the original ledger in tack. ETH started with the original ledger after it had been rolled back before the hacking event.

Ethereum Classic retained significant support, but not anywhere near as much as Ethereum. Both platforms currently use the Proof-of-Work algorithm for mining, although Ethereum plans to shift to Proof-of-Stake in 2021. For smaller platforms like ETC, the PoW algorithm can lead to what are called 51% attacks, where a miner achieves enough size to modify blocks and basically steal coins by creating double-spends. ETC has been plagued by these attacks – three occurring in August of 2020. In October of last year, Ethereum Classic finally implemented code protections meant to increase the cost of such attacks to millions of dollars.

Will these code fixes prevent 51% attacks in the future? The jury is still out, but interestingly enough, the prices for ETC rarely reacted to news of these attacks. Investors may be focused on price momentum and not security at the moment. ETC prices have been volatile. Its price today is $20.55, nearly half of its All-Time-High of $42.79 in 2018. Several analysts have predicted prices above $100 in the next few years, but these experts could be wrong. In any event, the market cap of Ethereum Classic is $2.4bn, which means that there are a subset investors that do value ETC.

Step by step guide

It is now easier to buy ETC than ever before. It used to be that only cryptocurrency exchanges would accept your fiat currency in exchange for cryptos, but now popular online brokers have joined the ranks. For example, eToro.com can have you owning ETC in five easy steps:

Step 1: Set up your account: Go to the eToro.com website and press ‘Join Now’ to start your investing adventure in cryptos.

Step 2: Complete your application. All brokers, by law, must ask ‘Know Your Customer’ queries to obtain your personal identification information. You will also be asked profile questions to assist the broker in serving your best interests.

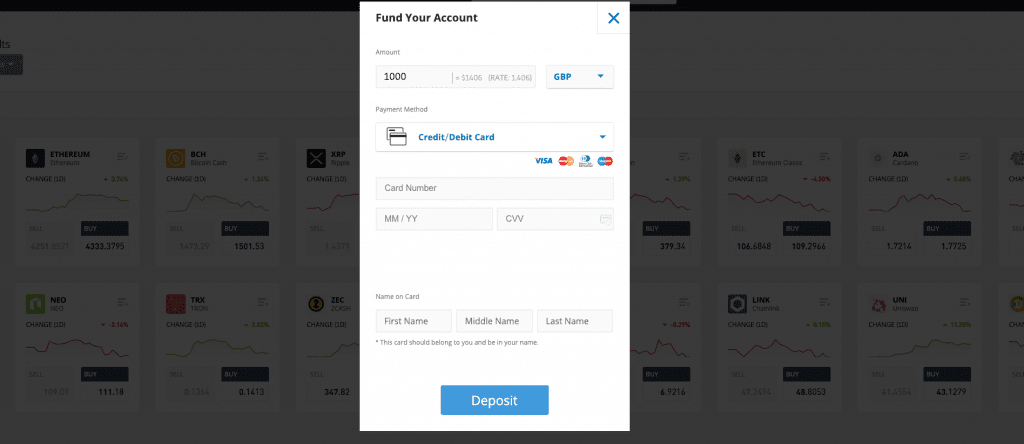

Step 3: Fund your account: After selecting the ‘Deposit Funds’ button in the lower-left corner of your desktop screen, eToro will show you a number of ways to deliver money to your account. The method of payment depicted here is for a credit/debit card.

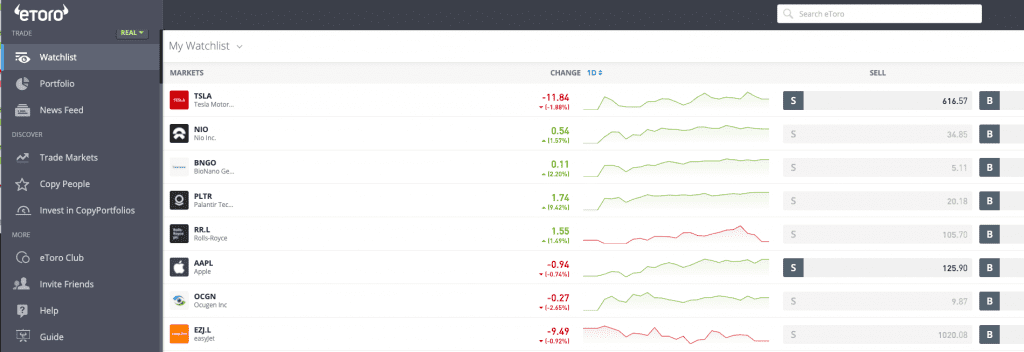

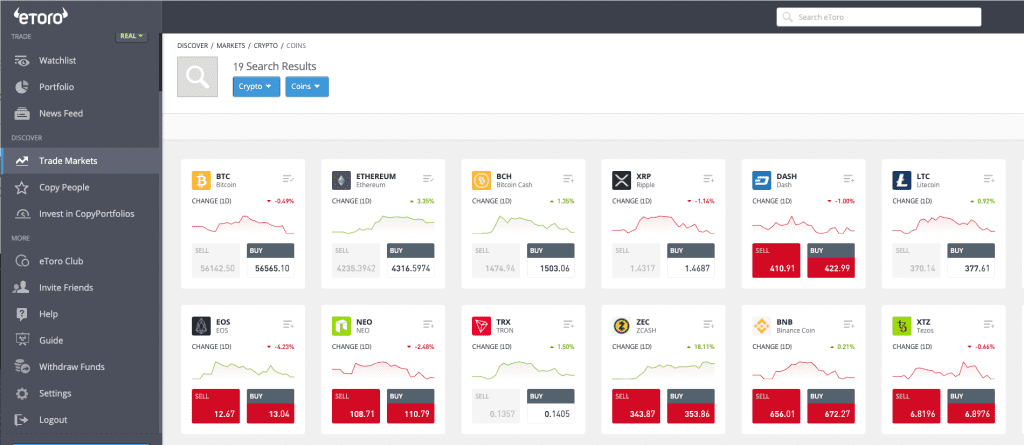

Step 4: Find ETC on your trading desktop: Once eToro posts the funds to your account, you are ready to trade. On your desktop, select ‘Trade Markets’ and then click on ‘Cryptos’ at the top of the screen. Scroll down until you come to ETC.

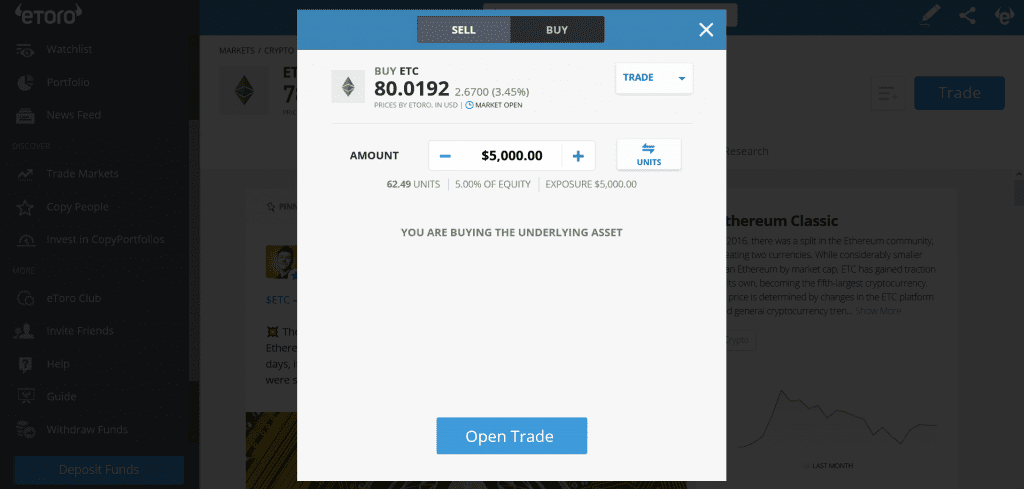

Step 5: Execute your Buy order: Press the ‘Buy’ button and an order screen will appear. Enter the amount of cash you wish to invest. When you press ‘Open Trade’, eToro will execute your order, compute the units purchased, deliver your units of ETC to your portfolio and then safeguard them appropriately in their proprietary wallet system.

Conclusion

If you are a crypto purist and wish to show your loyalty for such ideals as ‘the Code is Law’ and ‘the immutability of the blockchain is sacred’, then you may want to include ETC in your crypto portfolio. Its followers are definitely working diligently to fulfil their classic mission, but ETC is a high-risk investment, much higher than, say, Bitcoin or ETH. There has been price recovery in 2021, a sign of support from investors, and there may be potential for more appreciation.

As 51% attacks dissipate and more developers choose the ETC platform for their smart contracts and dapps, an investment in ETC could prove to be a good one in the long run. There is always a threat that regulators could muddy the waters or that ETH may attract most of the attention. Since ETC is so far down in its alt-coin ranking, small successes or failures can cause erratic price swings. Volatility will always be an issue. If you are in for taking chances, ETC stands out.